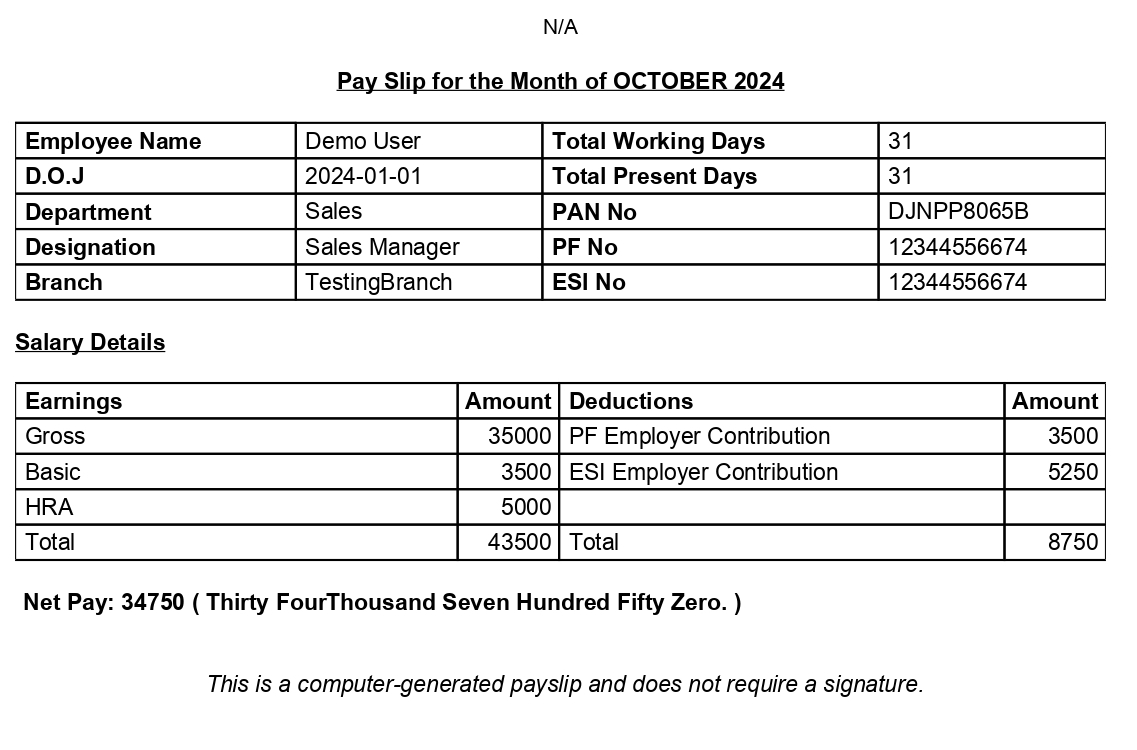

Streamline Payroll Processing with Circleplus.ai - Accuracy, Simplicity, Efficiency

Whether you’re a growing startup or a large enterprise, our solution scales with your needs, keeping payroll stress-free.

.avif)